The long view

Go through the thought process. Imagine setting out a 20-year asset allocation plan today. Stocks are at all-time price and valuation highs, bonds are closer to fair value, but credit spreads are super tight. Not easy, is it? Is the traditional mechanistic flightpath asset allocation appropriate for where we are? There are lots of risks potentially materialising. History suggests valuations are a concern for equities, especially in the US. Bonds, however, are set to potentially generate long-term gains close to current yield levels, consistent with average nominal GDP growth. Time is the friend of the long-term view, as should be discipline, rebalancing and compounding. Done correctly, history suggests a 10% compound annual return over a decent horizon is the reward for patience and planning.

- I still like credit in fixed income; it appears solid and demand is strong

- I am concerned about the disconnect between macroeconomic and political risks and markets

What will it take?

In several client meetings recently, the issue of what might burst the ‘risk-on’ bubble has been discussed. I think this reflects a general level of discomfort between perceived threats to the global outlook and markets’ remarkably strong performance. The US narrative continues to add to uncertainty, with the investment thesis around some climate change solutions and selected pharmaceutical products being challenged most recently. The gathering of world leaders at the United Nations General Assembly in New York highlighted the changed world of international relationships and the apparent difficulties in achieving peaceful solutions in Ukraine and Gaza. Leaders gathered against a backdrop of the world trading system being upended by the preference of the US for its own tariff-led approach rather than that of the multi-lateral framework embodied in the mission of the (now less effective) World Trade Organization. At the same time, risky assets are at extreme valuations, there are concerns about inflation, US Federal Reserve (Fed) independence, fiscal stability and a potential US recession. Yet markets appear to be complacent.

Quick or slow?

Picking a single event that would cause a market correction is difficult. Think about Liberation Day in April. What the White House announced should have elicited a negative market reaction. It did, but it didn’t persist because the implementation of tariffs was postponed. There are numerous individual risks to market sentiment – higher US inflation; a monetary policy mistake; a negative bond reaction to fiscal developments in the UK or France; and an escalation of security tensions in the east of Europe. We can’t trade on any one of these risks materialising - or having a long-term impact on valuations. The fact that the VIX index and corporate bond credit default swaps remain low suggests that investors have no appetite for hedging against any of the myriad risks materialising into realistic market drawdowns.

For what it’s worth, my bet is that if there is a market correction, it will be a more drawn-out affair. The US economy is slowing, at least outside of the artificial intelligence (AI) economy, and inflation will be running at an elevated rate for some time as tariff costs are increasingly passed on to consumer prices or reduce profit margins. Meanwhile there are deflationary forces elsewhere in the world. Somehow, it does not seem likely that nominal GDP growth can remain as robust as it has. All G7 countries, except for Japan, had a much lower year-on-year nominal GDP growth rate in the second quarter (Q2) than the average of the previous eight quarters. That has implications for corporate earnings growth and risk premiums.

Long-term expectations

For those that entertain themselves by checking in on LinkedIn on a regular basis, you might have come across posts of charts that show the relationship between market prices (valuations) and subsequent future returns. The most popular suggests current US equity market valuations would – if history is any guide – be consistent with annualised total returns of close to zero over the next 10 years. Using current versus subsequent changes in the price-to-earnings (P/E) ratio alludes to a similar outcome. When the P/E ratio has been near to today’s level in the past, the subsequent five to 10 years have seen between a five-to-10-point decline in the multiple. A 10-point decline in the P/E multiple over the next decade would require annual earnings per share for the S&P 500 to grow by a compound 16% if a 10% return from the market each year was to be maintained. That is asking a lot of AI-related earnings growth.

Of course, history does not guarantee future outcomes. However, there has never been 16% earnings growth over such a sustained period. The risk is the modest deterioration in US GDP growth and inflation extends to more of an economic malaise over time, undercutting risk valuations and returns.

Planning

It’s important for long-term investment strategies to have a view on what total returns might be over the medium term. Target retirement date strategies have become very popular in the US and the UK. These typically have an extended investment horizon, start with a high allocation to equities and gradually derisk as the strategy matures. They are based on the normative assumption that bonds are less volatile than stocks, and provide some diversification, and that as people near retirement they value stable income over uncertain growth. The problem is that recent experience has not been great. Bonds became very expensive in the decade after the global financial crisis, and the re-rating of bonds after 2021 destroyed performance. Savers would have been better served staying in equities since 2000 – the drawdowns in equities after the pandemic and the rates shock of 2021 were soon wiped out, while some bond positions remain underwater.

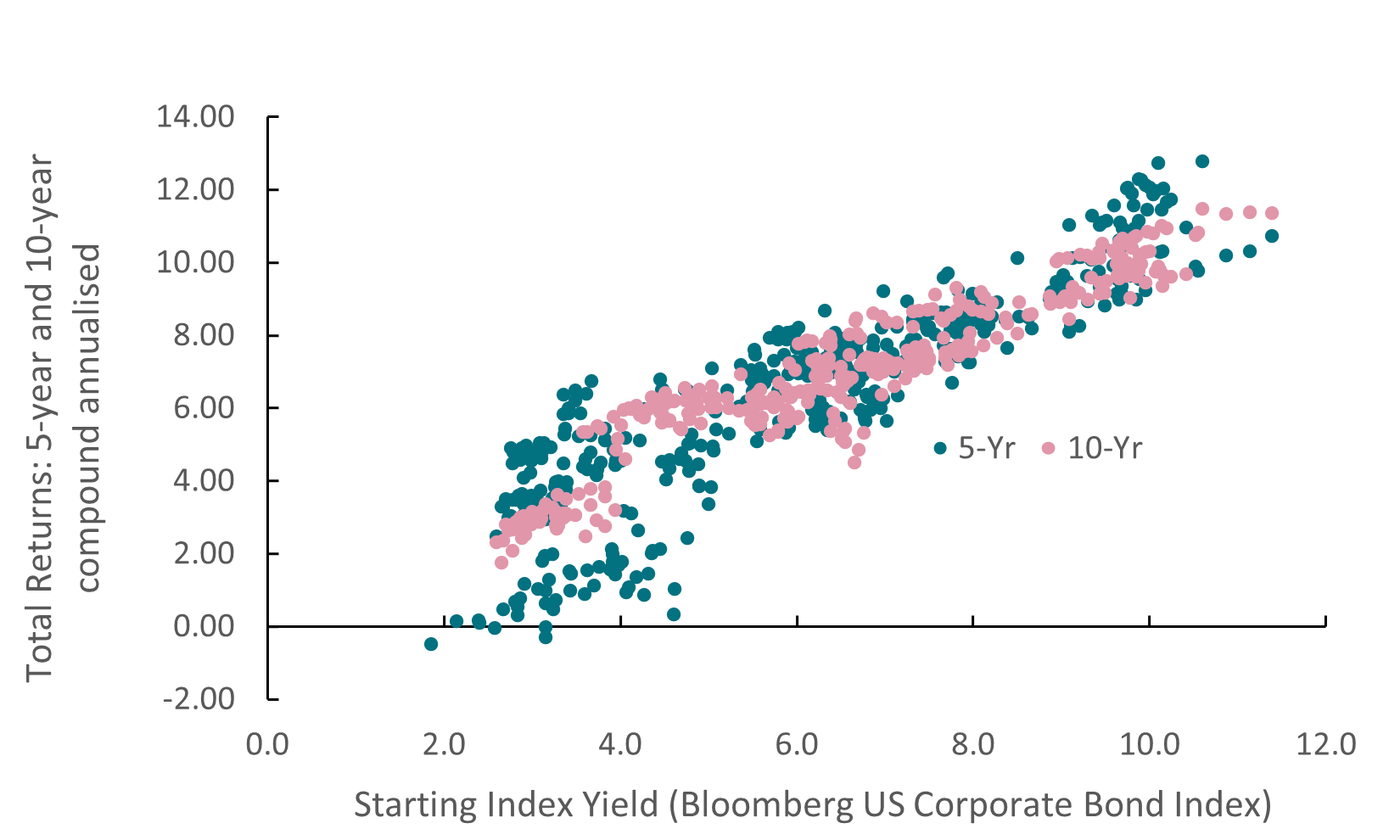

US Corporate Bond Index Returns

Source: ICE Bond Indices; Bloomberg – 25 September 2025

Different glidepath

The good news is that bonds are better value today. Doing the same valuation versus performance analysis, US government bonds - given where yields are today - should tend towards total annualised returns of 4.25% to 4.75% depending on the holding period (based on the regression of all maturity US Treasury yield and subsequent total return performance from a representative index). The data suggests, for US dollar investors, a much more balanced equity-bond allocation. High quality corporate bonds would give a little bit more fixed income performance. Sure, there are inflation and fiscal risks that can create mark-to-market volatility, but I am talking long-term investment strategies here and government bonds and high-grade corporate bonds are extremely likely to remain money good over such time periods. The traditional retirement glidepath might need to have a different starting point given the risks to equity returns from today’s valuations.

For European investors, the balance is in favour of equities over fixed income – a potential 7%-to-8% total return from stocks relative to 2% to 3% from bonds. A more positive view on European equity returns might also incorporate the potential for potential growth to improve if plans to invest in innovation, leverage progress on net zero, and increase spending on defence and infrastructure come to pass. Meanwhile, the frenzy of AI-related spending in the US might diminish at some point.

Ifs and tokens

All of this rests on economic and policy developments. Something must happen to break the US equity market to get multiples down to more sustainable levels. Something must happen to boost European growth. Inflation could again undermine returns from bonds. Moreover, passive allocations over a 30-to-40-year period might not be the most appropriate way to manage one’s retirement. A glidepath approach with decent diversification and some flexibility to change allocations based on contemporaneous valuations and macro developments could be a more fruitful approach. In time, this will also become more cost-effective as mass-market retail retirement investment products utilise technology such as the blockchain to give much cheaper access to underlying market developments. An AI-driven dynamic allocation of exposure to various bond and equity markets through cheap, easy-to-trade tokenised investments could well be the core of the asset management industry of the future.

Performance data/data sources: LSEG Workspace DataStream, ICE Data Services, Bloomberg, AXA IM, as of 25 September 2025, unless otherwise stated). Past performance should not be seen as a guide to future returns.

Disclaimer

La información aquí contenida está dirigida exclusivamente a inversores/clientes profesionales, tal como se establece en las definiciones de los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65/UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2025. Todos los derechos reservados.

AXA IM y BNP Paribas AM están fusionándose y reorganizando progresivamente nuestras entidades legales para crear una estructura unificada.

AXA Investment Managers se unió al Grupo BNP Paribas en julio de 2025. Tras la fusión de AXA Investment Managers Paris con BNP PARIBAS ASSET MANAGEMENT Europe y sus respectivas sociedades holding el 31 de diciembre de 2025, la nueva compañía ahora opera bajo la marca BNP PARIBAS ASSET MANAGEMENT Europe.