No data, no cry

There has been no official US economic data this month. Who cares? The markets have enough to go on to assume a benign macroeconomic backdrop. Equities are quietly digesting what appears to be a solid third quarter earnings season, while bonds are telling us that lower rates and decent growth trumps fiscal concerns for now. We await US technology companies’ earnings numbers but if the bond market mantra has always been “don’t fight the Federal Reserve (Fed)”, in equities it has become “don’t fight artificial intelligence (AI)”.

- Key macro themes – No US data but a benign slowdown remains the narrative

- Key market themes – Are equities set to rally into the holiday season?

No news is good news

Despite the absence of official US government data due to the federal shutdown, markets have continued to perform in a very benign way so far in October. Major US equity markets have taken a breather as earnings reports continue to come out. It’s likely the season will be sufficiently strong to support the belief that current valuations are sustainable, allowing for a potential move higher in stock markets in November, typically a strong month for S&P 500 performance. Equity markets elsewhere have performed well, with markets like Korea, Taiwan, Japan and India confirming that technology is a driver in more than just the US.

Source: Refinitiv Datastream

The power of rising wealth…

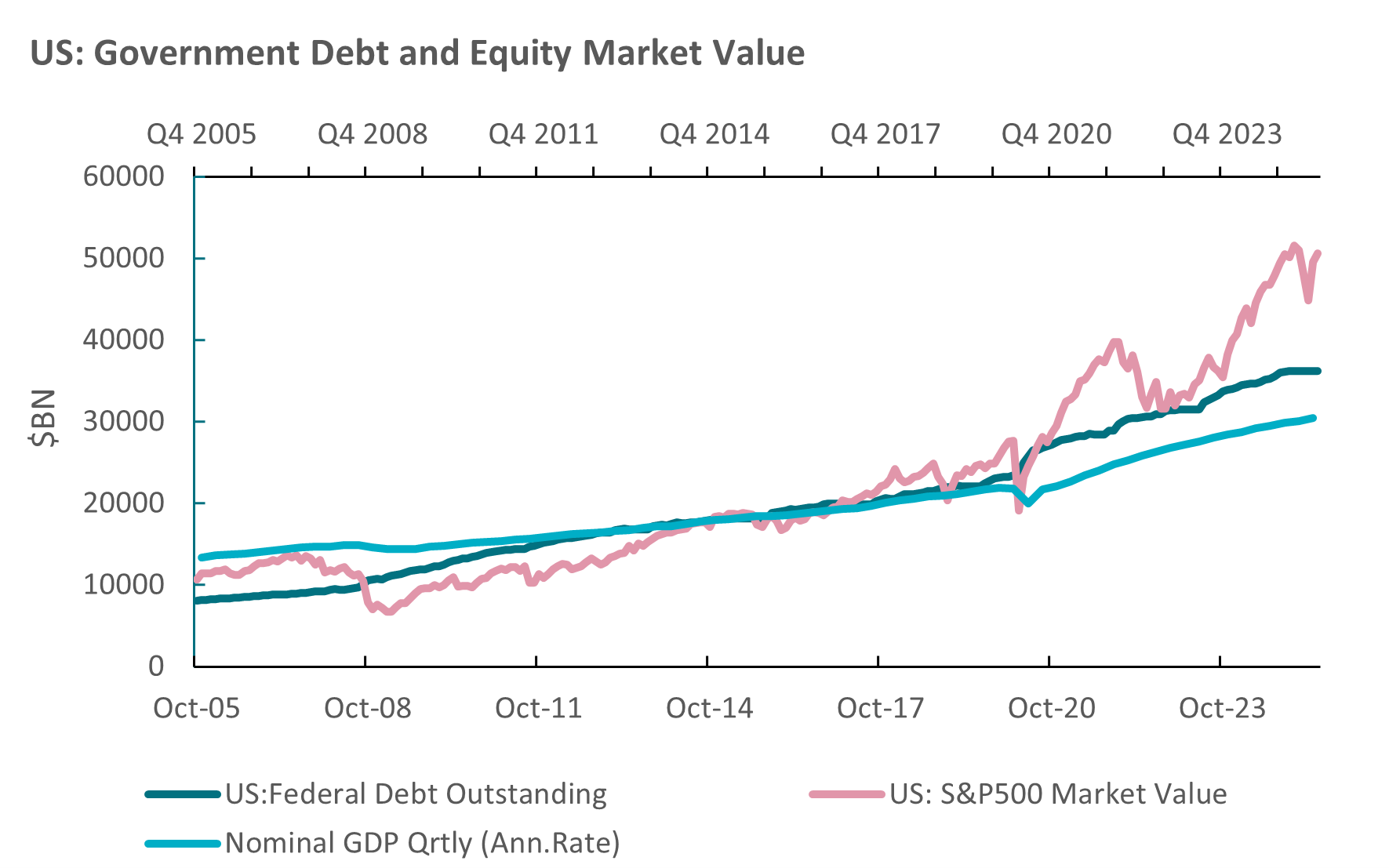

Rising equity markets mean rising wealth and support for economic growth. For now, this is outweighing concerns about public debt, especially in the US where equity market capitalisation as a percentage of GDP (around 165%) is much higher than public debt is as a percentage of GDP (125%) - see chart above. The equity buffer is lower in Europe, but strong equity performance is still positive for growth because it is based on companies delivering on real growth in revenues, which in turn is boosting investment spending with all the benefits that has for future activity and employment. Investors worry about how some governments will manage their public debt profiles, but growth is a necessary bulwark against debt unsustainability. So, for the sake of long-term premiums in fixed income markets, let’s hope the virtuous equity and economic growth circle can remain intact. An equity market correction leading to reduced growth expectations and tax revenues would not be good for the fiscal outlook, or for long-term bonds.

…and lower rates

Longer-duration bonds have outperformed core equities in the US and in Europe this month. The benchmark 10-year Treasury yield fell below 4% and expectations of additional easing by the Fed are well priced in. Without the economic snapshots provided by the usual monthly data, the narrative is that the Fed will ease because of softer labour market trends, and this will help cushion the economy, while high levels of capital spending on AI will raise expectations about future productivity growth. Even credit spreads have stabilised, after having jumped when US President Donald Trump threatened more tariffs on China. Market expectations are strongly biased towards a Fed rate cut on 29 October with another one coming before the end-of-year holidays. The bull market continues. Fears of inflation have receded.

I guess the near-term risk is that assumptions of where the economy is could drift away from the picture which is painted when official data releases resume. I doubt this is a big risk given the wealth of private sector data, ongoing data releases from other countries that are generally market-friendly (lower inflation in the UK for example), and the information provided by corporate earnings updates (which are generally positive). But it would be nice if governments just got on with the job of supporting economic growth rather than constantly being distracted by election positioning, infighting and being engaged in populist culture wars. Europe’s fiscal fears won’t be allayed until there is a clearer and more unified focus on growth. Hopefully, when Germany starts spending money that will come.

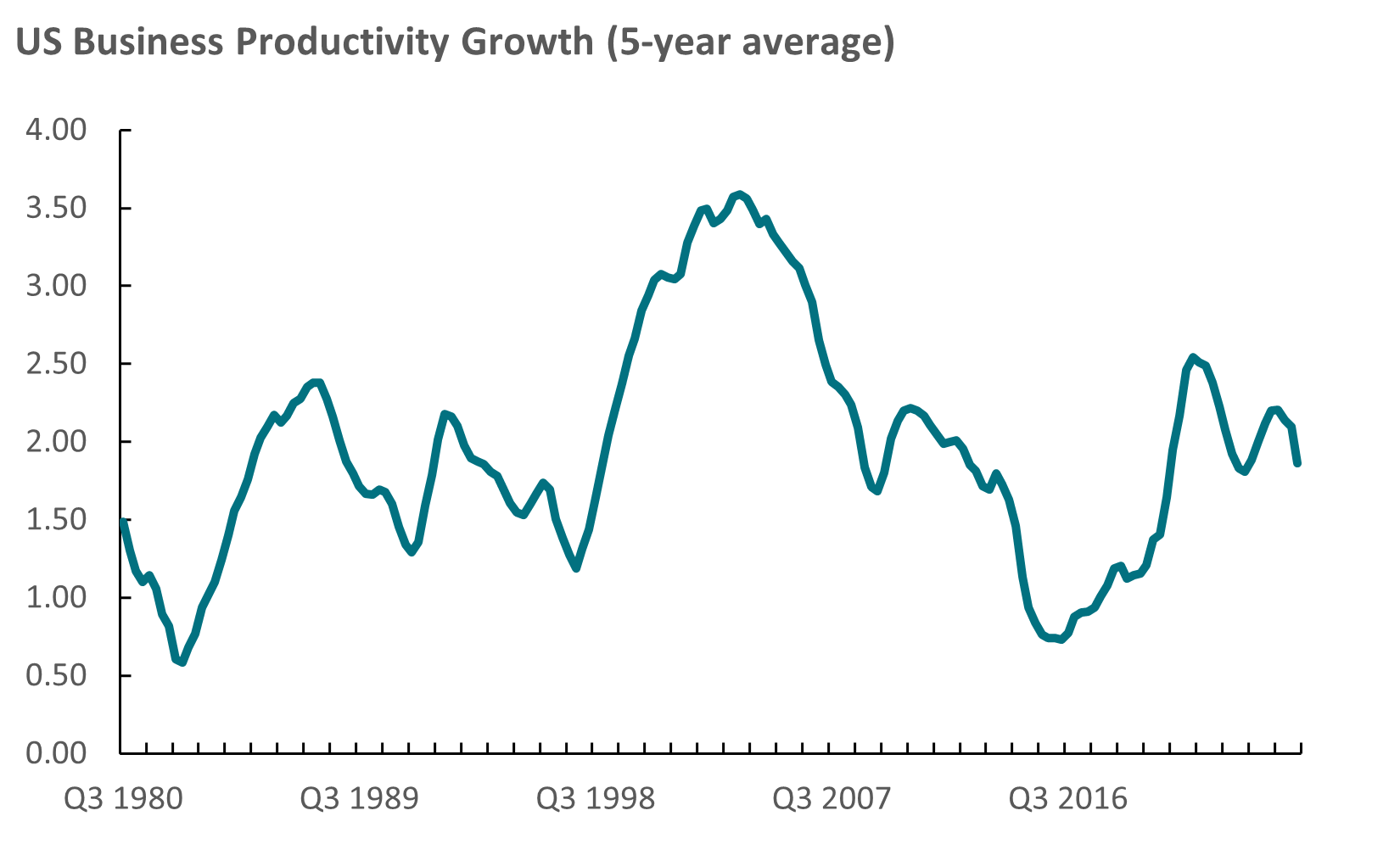

The bet on being more productive

Core to the AI transition of economic life is the belief that it will boost productivity, by being a lot better at a lot of jobs, that humans do today - so those in work will be more productive. Output per hour worked is the key measure of productivity. AI promises the same amount of output can be produced with fewer hours (people) worked, or that more output can be produced with the same hours worked. It is a slow-moving measure and there is some scepticism around technology developments and productivity – as economist Robert Solow said: "You can see the computer age everywhere but in the productivity statistics." However, US data shows labour productivity did increase in the years after the digital revolution got going in the mid-1990s (the five-year average annual business productivity rate reached 3.5% at the beginning of the 2000s, see chart below). Increased digitalisation, automation, data storage and communication all contributed to the surge in productivity and another surge is expected by AI enthusiasts. If they are right, then the cycle can be extended, and we should start to see the benefits across the economy. AI can certainly play a key role in meeting the long-term challenges of fiscal stability (improved performance in the public sector), dealing with labour shortages in ageing societies, providing better and cheaper health provision, and optimising green energy and climate change adaption. But the effects take time because companies and individuals must learn how to use new technology and pay for it.

Source: US Bureau of Labor Statistics; AXA IM

And a bet on electrons

Huge infrastructure is required to make productivity and other ambitions real. It is clearly being built to the benefit of companies that are manufacturing hardware, developing cloud services, and developing the foundation models. I continue to be amazed at how much is being spent. I am also struck by how much energy is being required to power this growth. Installed capacity in US electricity generating is growing rapidly, led by non-utility power generators in the private sector and focussed mostly on solar, wind and natural gas. The American Public Power Association estimates that between 2017-2024, solar and wind accounted for around 78% of additional electricity generating capacity. The International Energy Agency forecasts that electricity demand is currently growing at 4% per year with a lot of the demand coming from data centres but also from countries which are seeing rapid growth in per capital income (India for example).

Transformational investment flows

Cotton-spinning needed water. Steelmaking needed coking coal. Mass transportation needed oil. AI needs electricity, and electricity needs to be renewable. This is a sector that will keep growing and keep providing investment opportunities for all types of investors – pension funds in long-term infrastructure projects, private equity and debt opportunities in technology-driven services supporting more grid and off-grid delivery of electricity, and in the equity markets as demand for power will exceed generating capacity for some time and more companies will be able to demonstrate the productivity (and profitability) gains from AI.

The future – greener, more efficient?

AI and the green transition are the most important economic trends of this epoch, and electricity generation is powering the growth of new technologies. Both can provide fundamental improvements to the human condition. More and more investment capital is being directed to these sectors because investors can see the long-term return from being invested in transformational businesses. The good thing is that this does not necessarily mean being just exposed to the ‘Magnificent Seven’ group of mega-cap US technology stocks – upstream power and engineering and downstream applications are providing those opportunities. The economies that embrace electrification, renewable power generation, and support the development of AI for productive purposes will be those that grow the most and will be most capable of providing the public services that many of the advanced economies today are struggling with. Finally, when we think about what blockchain technologies can bring to improve the financial sector’s efficiency, including the greater mobilisation of savings for productive purposes, one can get quite excited about an electric future.

Performance data/data sources: LSEG Workspace DataStream, ICE Data Services, Bloomberg, AXA IM, as of 23 October 2025, unless otherwise stated). Past performance should not be seen as a guide to future returns.

Disclaimer

La información aquí contenida está dirigida exclusivamente a inversores/clientes profesionales, tal como se establece en las definiciones de los artículos 194 y 196 de la Ley 6/2023, de 17 de marzo, de los Mercados de Valores y de los Servicios de Inversión.

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65/UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales y/o sucursales de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2025. Todos los derechos reservados.

AXA IM y BNP Paribas AM están fusionándose y reorganizando progresivamente nuestras entidades legales para crear una estructura unificada.

AXA Investment Managers se unió al Grupo BNP Paribas en julio de 2025. Tras la fusión de AXA Investment Managers Paris con BNP PARIBAS ASSET MANAGEMENT Europe y sus respectivas sociedades holding el 31 de diciembre de 2025, la nueva compañía ahora opera bajo la marca BNP PARIBAS ASSET MANAGEMENT Europe.