Metaverse Mythbusters

Key points:

- The Metaverse is already a new and exciting source of opportunities, with unprecedented potential for scale

- The pace of technological advances has accelerated over the past 50 years, allowing credible opportunities to become investible far earlier

- We aim to clarify some of the most common questions or misconceptions that investors may have

The Metaverse has created a significant amount of buzz in the investment sphere as well as the technology industry and wider media, and with good reason. With a projected global market size of over $800bn by 2030

Isn’t the Metaverse a relatively new phenomenon?

The Metaverse is exciting source of opportunities due to its ability to draw upon the advances in technological capabilities across hardware, software and infrastructure that, after several decades of development, now move at a far faster pace. There had previously been four key computing platforms introduced over the past 50 years

How do you find meaningful opportunities amongst the hype, and mitigate the risk of early adoption?

The respected business analysis firm Gartner publishes a ‘Hype Cycle’ for innovative, emerging technologies which are expected to disrupt the existing markets. The Metaverse has made multiple appearances on this annually published chart under various guises such as augmented reality (AR) and virtual reality (VR) which were languishing at the bottom of expectations in 2017. For 2022, the Metaverse collectively appears strongly back in the ‘rising expectations’ segment of the chart and is not expected to plateau for more than ten years (which suggests a promisingly tong-term growth horizon)

‘The Metaverse’ sounds niche compared to traditional technology strategies, is there a sufficiently large investment universe for investors?

One of the key drivers of the Metaverse’s potential is the scope and scale that is possible. It’s true that its early origins sit within the gaming world, but now its capabilities are being recognised by major players in industry and in the workplace (see our previous articles on Metaverse Working, and Enablers). Another important point to consider is the concurrent rise of capabilities in artificial intelligence (AI), which exists synergistically alongside the Metaverse and allows it to grow at an even faster pace by utilising technologies that can work more rapidly and more efficiently than a human can.

Of course, one must also not underestimate the depth of opportunities in the core gaming and socialising themes of the Metaverse. Almost 40% of the world’s population are estimated to have played games in 2022 – a potential consumer base of three billion people cannot be dismissed.

OK, sounds promising, but how can this concept be adequately captured in an investment portfolio?

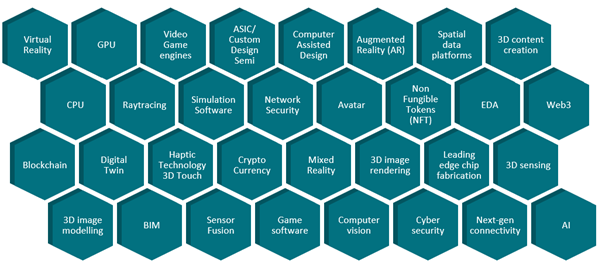

As suggested by the Gartner research, we are at the early innings of a significant transformation, which should gradually unleash its full potential in the next decade. This presents a huge opportunity to invest in the pioneering technology companies of today – many of those positioned at the leading edge of innovation. Investing in these companies offers exposure to a range of underlying technologies, which we characterise as the building blocks that underpin the development of the Metaverse. These blocks come together to form what we refer to as the ‘Metaverse Wall’. To paraphrase Gartner, it is our expectation that the Metaverse cannot be defined as a single technology, but a rather a combination of numerous individually important, discrete and independently evolving technologies that interact with one another to give rise to a mega trend – the Metaverse.

The Metaverse Wall:

Source: AXA IM for illustrative purposes only.

We want to participate in the growth of the Metaverse and all of its associated, promising opportunities in line with an investment philosophy, which favours quality growth companies. While the timeline for the Metaverse’s rise to prominence may be up for debate, a robust investment approach can aim to ensure focus on combining Metaverse relevance with solid fundamentals.

Companies shown are for illustrative purposes only as of 20/04/2023. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalised recommendation to buy or sell securities.

Risks

No assurance can be given that our equity strategies will be successful. Investors can lose some or all of their capital invested. Our strategies are subject to risks including, but not limited to: equity; emerging markets; global investments; investments in small and micro capitalisation universe; investments in specific sectors or asset classes specific risks, liquidity risk, credit risk, counterparty risk, legal risk, valuation risk, operational risk and risks related to the underlying assets.

Disclaimer

Este documento tiene fines informativos y su contenido no constituye asesoramiento financiero sobre instrumentos financieros de conformidad con la MiFID (Directiva 2014/65 / UE), recomendación, oferta o solicitud para comprar o vender instrumentos financieros o participación en estrategias comerciales por AXA Investment Managers Paris, S.A. o sus filiales.

Las opiniones, estimaciones y previsiones aquí incluidas son el resultado de análisis subjetivos y pueden ser modificados sin previo aviso. No hay garantía de que los pronósticos se materialicen.

La información sobre terceros se proporciona únicamente con fines informativos. Los datos, análisis, previsiones y demás información contenida en este documento se proporcionan sobre la base de la información que conocemos en el momento de su elaboración. Aunque se han tomado todas las precauciones posibles, no se ofrece ninguna garantía (ni AXA Investment Managers Paris, S.A. asume ninguna responsabilidad) en cuanto a la precisión, la fiabilidad presente y futura o la integridad de la información contenida en este documento. La decisión de confiar en la información presentada aquí queda a discreción del destinatario. Antes de invertir, es una buena práctica ponerse en contacto con su asesor de confianza para identificar las soluciones más adecuadas a sus necesidades de inversión. La inversión en cualquier fondo gestionado o distribuido por AXA Investment Managers Paris, S.A. o sus empresas filiales se acepta únicamente si proviene de inversores que cumplan con los requisitos de conformidad con el folleto y documentación legal relacionada.

Usted asume el riesgo de la utilización de la información incluida en este documento. La información incluida en este documento se pone a disposición exclusiva del destinatario para su uso interno, quedando terminantemente prohibida cualquier distribución o reproducción, parcial o completa por cualquier medio de este material sin el consentimiento previo por escrito de AXA Investment Managers Paris, S.A.

La información aquí contenida está dirigida únicamente a clientes profesionales tal como se establece en los artículos 205 y 207 del texto refundido de la Ley del Mercado de Valores que se aprueba por el Real Decreto Legislativo 4/2015, de 23 de octubre.

Queda prohibida cualquier reproducción, total o parcial, de la información contenida en este documento.

Por AXA Investment Managers Paris, S.A., sociedad de derecho francés con domicilio social en Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, inscrita en el Registro Mercantil de Nanterre con el número 393 051 826. En otras jurisdicciones, el documento es publicado por sociedades filiales and/ or branches de AXA Investment Managers Paris, S.A. en sus respectivos países.

Este documento ha sido distribuido por AXA Investment Managers Paris, S.A., Sucursal en España, inscrita en el registro de sucursales de sociedades gestoras del EEE de la CNMV con el número 38 y con domicilio en Paseo de la Castellana 93, Planta 6 - 28046 Madrid (Madrid).

© AXA Investment Managers Paris, S.A. 2023. Todos los derechos reservados.

AXA IM y BNP Paribas AM están fusionándose y reorganizando progresivamente nuestras entidades legales para crear una estructura unificada.

AXA Investment Managers se unió al Grupo BNP Paribas en julio de 2025. Tras la fusión de AXA Investment Managers Paris con BNP PARIBAS ASSET MANAGEMENT Europe y sus respectivas sociedades holding el 31 de diciembre de 2025, la nueva compañía ahora opera bajo la marca BNP PARIBAS ASSET MANAGEMENT Europe.